Earned wage access benefits extend far beyond faster pay; they reduce employee financial stress, improve retention, and support a more productive and engaged workforce. For employers, offering Earned Wage Access (EWA) is a strategic advantage in today’s competitive labor market. This guide explains how EWA works, why it matters, and what makes an employer-integrated model the safest and most effective option. Whether you’re exploring financial wellness solutions or seeking to modernize your payroll offering, this guide will help you understand the full value of Earned Wage Access for both your employees and your business.

Quicklinks

- 1. What Is Earned Wage Access (EWA)

- 2. What Are the Benefits of Earned Wage Access for Employees?

- 3. What Are the Benefits of Earned Wage Access for Employers?

- 4. How Does Earned Wage Access Work for Companies?

- 5. How Is Earned Wage Access Different from Payday Loans?

- 6. What Makes the FlexWage EWA Model Different?

- 7. How to Get Started with Earned Wage Access

- 8. Earned Wage Access (EWA) Benefits: Frequently Asked Questions (FAQs)

- 9. Resources to Explore Earned Wage Access Further

1. What Is Earned Wage Access (EWA)

Earned Wage Access (EWA) is a voluntary benefit that allows employees to access a portion of their earned wages before payday. Rather than waiting for a fixed pay cycle, employees can tap into the money they’ve already earned, helping them manage bills, avoid late fees, and reduce financial stress.

The ability to access earned wages on demand not only improves employees’ financial stability but also benefits employers through stronger retention, reduced absenteeism, and better overall performance. In today’s tight labor market, EWA is quickly becoming a must-have benefit for companies that want to show they care and stand out from the competition.

How Does Earned Wage Access Work?

The way EWA works depends on the provider. But at its core, it’s about providing employees with safe and responsible access to wages they’ve already earned.

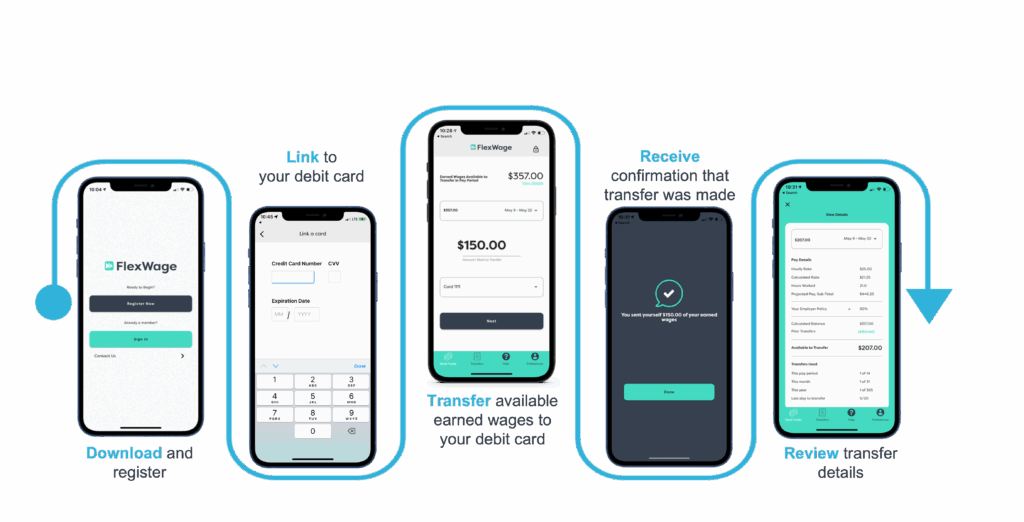

With an employer-integrated model like FlexWage, the process is straightforward:

→ Earned wages are calculated in real-time using payroll and time/attendance data.

→ Employees request access through an app or platform.

→ Funds are delivered instantly to the employee’s account of choice.

→ On payday, the accessed amount is automatically deducted through payroll (no guesswork, no manual tracking).

This integrated approach ensures accuracy and protects both the employer and the employee. It also avoids the pitfalls of direct-to-consumer (D2C) models, which often use estimated hours, external repayment contracts, or bank account redirects that increase risk.

Is Earned Wage Access the Same as a Loan?

Employer-integrated earned wage access is not a loan.

That’s one of the most important things to understand about EWA. There’s no interest. No credit check. No debt. Employees are simply receiving money they’ve already earned but haven’t yet been paid.

Unlike payday loans or direct-to-consumer early wage products that rely on wage assignments or third-party repayment tactics, a compliant EWA program:

→ Works with payroll data

→ Avoids assigning wages or rerouting entire paychecks

→ Uses transparent, capped fees

→ Never sends employees into debt

This clear separation from traditional credit products is part of why employer-integrated models, such as FlexWage’s, stand out, and why regulatory bodies, including the Consumer Financial Protection Bureau (CFPB) and state regulators, treat them differently.

What Is Employer-Integrated Earned Wage Access?

Employer-integrated EWA is a payroll-connected solution that allows employees to access their earned wages directly through their employer’s payroll system. The EWA provider integrates with the employer’s payroll and timekeeping systems, enabling the precise calculation of earned wages and the automated deduction of accessed funds on the next payday.

What Is Direct-to-Consumer EWA?

Direct-to-consumer (D2C) EWA models operate outside the employer’s systems. In these arrangements, the EWA provider offers an app or service directly to the employee, calculates an estimated amount of wages earned, and transfers funds to the employee independently of payroll.

Other Names for Earned Wage Access (EWA)

As Earned Wage Access becomes more widely adopted, it’s also being referred to by a growing list of alternate names, especially in marketing materials and employee-facing communications. These include on-demand pay, daily pay, instant pay, early wage access, accrued wage access, and salary-on-demand. Some providers also use terms like pay-on-demand or flexible pay to emphasize the employee’s ability to choose when they’re paid.

While the terminology may differ, the concept remains the same: providing employees with timely access to money they’ve already earned. However, how that access is delivered, and whether it’s done in a compliant, employer-integrated way, makes all the difference.

2. What Are the Benefits of Earned Wage Access for Employees?

One of the most significant benefits of Earned Wage Access is its direct impact on the financial and emotional well-being of employees. When workers have timely access to their already-earned wages, they’re better equipped to manage everyday expenses and unexpected emergencies without turning to risky, high-cost alternatives.

Let’s explore the specific ways EWA helps employees reduce stress, avoid predatory lending traps, and feel more secure and supported at work.

How Does EWA Reduce Financial Stress?

Employees don’t plan for emergencies, but they happen anyway. When a key team member faces an unexpected expense days before payday, they often turn to payday loans, rack up overdraft fees, or might miss work entirely in an effort to find a solution. These scenarios negatively impact productivity, morale, and employee retention. Earned Wage Access (EWA) offers a better alternative, providing employees with timely access to the wages they’ve already earned, which helps them stay focused, present, and financially stable.

Financial stress is one of the leading causes of distraction, absenteeism, and turnover in the workplace. Surveys indicate that 69% of Americans live paycheck to paycheck, and according to PwC’s Employee Financial Wellness Survey, 57% of employees cite financial stress as their top source of stress in life.

With Earned Wage Access, employees can access a portion of their wages as they earn them, giving them more control and flexibility to manage bills, emergency expenses, medication costs, or childcare costs without falling behind. This real-time access acts as a financial buffer, helping them handle life’s curveballs without the panic that comes from waiting for payday.

Employers that provide EWA empower their teams to regain control of their finances, which in turn leads to greater focus and job satisfaction.

“EWA provides a critical stepping stone that allows your employees to stay financially above water. Avoiding the pitfalls of overdraft, late fees, or short-term lending enables workers to begin looking forward and planning.”

— Frank Dombroski, Founder & CEO, FlexWage

Does EWA Help Employees Avoid Payday Loans and Overdraft Fees?

Yes, and that’s one of the most meaningful Earned Wage Access benefits for workers living paycheck to paycheck. When faced with unexpected expenses, such as car repairs or medical bills, many employees turn to payday lenders or incur costly overdraft fees to get by.

EWA offers a safer, more affordable alternative.

By giving employees access to earned wages, they can avoid:

→ Payday loans with interest rates exceeding 300%

→ Bank overdraft fees averaging $30–$35 per transaction

→ Borrowing from friends or family, which can strain relationships

EWA doesn’t involve new debt or complex repayment terms. It allows workers to access what they’ve already earned, so they can avoid the traps that exacerbate financial challenges.

Can EWA Improve Job Satisfaction and Engagement?

Yes! When employees feel financially supported, they are more likely to feel valued by their employer. Offering Earned Wage Access sends a powerful message: We care about your well-being, not just your work output.

A well-implemented EWA program can:

→ Strengthen trust between employees and leadership

→ Reduce stress-related distractions on the job

→ Increase overall morale and retention

In today’s competitive job market, benefits that improve financial wellness also support recruitment and retention efforts. EWA is a tangible way to build a healthier, more loyal workforce.

3. What Are the Benefits of Earned Wage Access for Employers?

While Earned Wage Access benefits employees directly, the business case for offering EWA is equally compelling. Employers who implement a compliant, integrated EWA solution can expect measurable improvements in retention, recruitment, productivity, and company reputation. In today’s labor market, where financial stress impacts performance and job satisfaction, EWA is a strategic approach to workforce management.

Let’s look at how EWA impacts key areas of employer success.

Does EWA Help Improve Employee Retention?

Yes. One of the most significant benefits of Earned Wage Access for employers is improved employee retention.

Financial instability can lead to burnout, absenteeism, and job hopping. When employees feel unsupported during financial emergencies, they’re more likely to disengage or leave entirely. EWA demonstrates to employees that their employer values their well-being, which in turn fosters a sense of loyalty.

Companies offering EWA report measurable reductions in turnover, particularly in industries with high employee turnover rates, such as healthcare, hospitality, manufacturing, and logistics.

Even minor improvements in retention can yield significant cost savings when factoring in hiring, training, and productivity loss.

Can EWA Improve Recruitment and Hiring Outcomes?

Absolutely. Offering Earned Wage Access can give your organization a competitive edge when it comes to attracting top talent. According to a Visa Direct study, 79% of surveyed employees said they’d be willing to switch to a job that offers EWA.

In job postings, “on-demand pay” or “get paid daily” perks can attract applicants faster, especially in industries where hourly workers are in high demand. Candidates view EWA as a sign that a company values financial wellness and progressive workplace policies.

Adding EWA to your benefits package also helps differentiate your brand and position your company as a leader in employee care and innovation.

Does EWA Increase Productivity and Reduce Absenteeism?

Yes. Financial stress leads to distraction, missed work, and lower productivity. One report states that absenteeism and tardiness have increased by 34% due to financial stress. When employees don’t have access to the money they’ve already earned, they may spend time:

→ Worrying about bills

→ Looking for outside loans or gig work

→ Calling in sick due to stress or transportation issues

EWA alleviates this strain by providing employees with a means to meet their financial obligations without incurring new debt or stress. That increased financial stability translates into more focused, present, and reliable employees.

How Does EWA Support ESG and Financial Wellness Goals?

As more companies prioritize environmental, social, and governance (ESG) initiatives, financial wellness has emerged as a key metric within the “S” (social) pillar of ESG. EWA aligns with this by helping to:

→ Close gaps in financial equity

→ Support underserved employees

→ Promote responsible financial practices

Offering EWA signals that your company is not only profit-focused but people-focused.

How Does Offering EWA Enhance Your Employer Brand?

Offering Earned Wage Access strengthens your reputation as an employer of choice. In today’s competitive job market, candidates are looking for more than salary. They want to know that their employer supports their well-being, values financial transparency, and is willing to invest in modern benefits that make life easier.

Earned wage access benefits your brand in three key ways:

1. Signals innovation and care: EWA tells candidates and current employees that your company is forward-thinking and empathetic. It positions your organization as one that adapts to the real-world needs of employees, rather than relying solely on traditional benefit structures.

2. Improves reviews and referrals: When employees feel supported financially, they’re more likely to leave positive reviews on sites like Glassdoor and Indeed, and to refer friends and colleagues to apply. These organic reputation signals carry weight in employer branding and hiring outcomes.

3. Differentiates you in crowded industries: Whether you’re in healthcare, logistics, retail, or manufacturing, offering Earned Wage Access can help you stand out from competitors who rely on outdated pay cycles. Candidates will remember the company that helped them access money when they needed it most.

Ultimately, the Earned Wage Access benefit sends a clear message: We care about your life, not just your labor. And in a hiring landscape where top talent can choose where they work, that message matters more than ever.

4. How Does Earned Wage Access Work for Companies?

Understanding how Earned Wage Access functions on the employer side is essential when evaluating potential providers. While many vendors claim to offer similar Earned Wage Access benefits, the underlying delivery model can significantly impact your compliance, payroll integration, and employee satisfaction outcomes.

Let’s explore how EWA works operationally and how to identify a trustworthy solution.

What’s the Difference Between Employer-Integrated and Direct-to-Consumer EWA?

Not all EWA programs are created equal. The most critical distinction is whether the solution is employer-integrated or direct-to-consumer (D2C).

Employer-integrated – Also known as employer-based, employer-integrated EWA (like FlexWage OnDemand Pay) works directly with data from the company’s payroll and time/attendance systems. Wages accessed early are calculated in real time (or near real time), funded by the employer, and repaid via payroll deduction. This ensures accuracy, transparency, and complete employer oversight.

Direct-to-consumer EWA, by contrast, typically estimates earnings without the employer’s involvement. These solutions often require employees to route their entire paycheck through a partner bank, use wage assignments, or accept terms that resemble credit products, all of which introduce legal and operational risks.

For HR and payroll leaders, selecting an employer-integrated model means maintaining control, avoiding compliance issues, and delivering a seamless benefits experience.

Download Your Copy of This Guide

Download a PDF version of this guide: Earned Wage Access Benefits: What They Are and Why Employers Should Care.

How Is EWA Funded and Repaid?

In an employer-based model, funding is provided by the employer, rather than a third-party lender or financial intermediary. When an employee accesses their earned wages early, the transaction is logged in the system and automatically deducted from their next paycheck through standard payroll processing.

This model offers several advantages:

→ No need to alter direct deposit information

→ No routing entire paychecks through external banks

→ No overpayments

→ No insufficient funds or overdraft fees

→ No employee debt or repayment confusion

For employers, it’s a clean, auditable process. And for employees, it preserves choice, transparency, and financial autonomy.

In contrast, some Direct-to-Consumer (D2C) models rely on intercepting direct deposits or assigning wages, approaches that not only bypass employer systems but also increase legal, financial, and reputational risk. That’s why many organizations are turning to employer-integrated models that put control, compliance, and transparency back where they belong: with the employer.

How Do Employers Control Eligibility and Usage?

A critical question for HR and payroll leaders evaluating EWA solutions is: What level of visibility and control will you have once the program is in place? With a properly integrated EWA solution, employers retain complete control over who is eligible for the benefit and how it’s used. This includes the ability to:

→ Set eligibility rules (e.g., tenure, job type, hours worked)

→ Limit the frequency or percentage of early wage access available

→ Monitor usage trends across departments

→ Analyze the impact on absenteeism, turnover, and satisfaction

These controls enable HR and payroll teams to strike a balance between flexibility and responsibility, ensuring the benefit is used to support, rather than replace, healthy financial behavior.

This level of oversight is impossible with most direct-to-consumer solutions, which operate independently of employer systems and often provide no visibility into data back to the company.

What Kind of Employee Engagement Support Should Employers Expect?

Even the best Earned Wage Access solution won’t drive results if employees don’t understand how it works or that it even exists. That’s why the strongest EWA providers offer comprehensive employee engagement support as part of the implementation process, employee onboarding, and open enrollment.

Your EWA provider should deliver a complete employer engagement kit, including:

Print Materials

→ Eye-catching flyers and posters to place in break rooms, time clock areas, and common spaces

→ Customizable enrollment handouts

Digital and Web Assets

→ Landing page copy and graphics for your internal HR or intranet site

→ Digital signage and banner ads for display screens or employee portals

→ Content for external career pages to help position EWA as part of your recruiting value proposition

Manager and HR Training

→ Briefing materials for supervisors and team leads to answer employee questions confidently

→ Talking points for new hire orientation or benefits overview meetings

→ Tips for fielding questions and reinforcing responsible usage

Employee FAQs and How-To Guides

→ Easy-to-read guides for how to enroll, access earned wages, and understand fee structures

→ Answers to common questions about timing, limits, repayment, and eligibility

When this kind of engagement toolkit is integrated into the rollout plan, employers experience higher adoption rates, greater satisfaction, and a faster time to value. Significantly, it also reduces the burden on HR teams by anticipating questions and providing ready-made resources.

5. How Is Earned Wage Access Different from Payday Loans?

While Earned Wage Access (EWA) and payday loans may appear similar at a glance (both providing access to cash between paychecks), the underlying mechanics, risks, and outcomes are fundamentally different. It’s important for employers, HR leaders, and benefits decision-makers to understand these differences to protect employees and their own organizations.

EWA is not a loan. When delivered through a responsible, employer-integrated model, it offers employees access to wages they’ve already earned, with no interest, no debt, and no credit checks. Payday loans, on the other hand, are short-term lending products that often come with high fees, predatory repayment terms, and long-term financial consequences.

What Are the Risks of High-Cost Lending Options?

High-cost lending options, such as payday loans, title loans, and cash advances, are widely available to workers in financial distress. However, they often exacerbate a tough situation.

The risks include:

→ Triple-digit APRs: Payday loans often carry annualized interest rates exceeding 300%.

→ Debt cycles: Borrowers frequently roll over loans, paying fees after fees without reducing the principal.

→ Aggressive collection practices: Missed payments can lead to account garnishment, wage assignment, or threats of legal action.

→ Credit damage: Defaults are often reported to credit bureaus, which can harm long-term credit health.

→ Employee stress and absenteeism: The financial burden of repaying payday loans can lead to disengagement, stress-related illness, and absenteeism.

In short, payday loans solve short-term liquidity problems by creating long-term financial harm, especially for employees already struggling to make ends meet.

Fortunately, there’s a better way.

How Does EWA Provide a Safer Alternative?

Earned Wage Access benefits employees by providing a low-risk, employer-supported alternative to payday loans. Rather than relying on high-interest credit or legal workarounds, EWA delivers employees with timely access to wages they’ve already earned, without debt, interest, or surprises. The best models, such as FlexWage, are designed to protect workers from predatory practices while providing employers with the necessary oversight.

Here’s how EWA differs from high-cost lending:

| Payday Loans | Earned Wage Access (Employer-Integrated) |

| High interest rates (often >300%) | No interest; fixed, transparent fee |

| Requires borrowing future wages | Accesses wages already earned |

| Debt-based lending with credit risk | No credit check, no debt |

| Third-party collections or wage assignment | Payroll deduction with employer oversight |

| No employer involvement | Employer-funded and employer-controlled |

These safeguards matter for employees and for the employers who rely on them. When employees have a safe and predictable way to manage short-term cash needs, the result is greater financial wellness, improved performance, and lower turnover.

6. What Makes the FlexWage EWA Model Different?

Not all Earned Wage Access (EWA) programs are created equal. While many vendors offer on-demand access to wages, the delivery model and its implications can vary dramatically. That’s why employers must look beyond marketing claims and examine how the solution is designed and built.

FlexWage stands out with a patented, employer-integrated approach that provides EWA benefits without introducing unnecessary risk or complexity.

Let’s explore the key differences.

“Empowering employees was our driving motivation when we created OnDemand Pay (EWA) in 2009, and it remains our primary focus.”

— Frank Dombroski, Founder & CEO, FlexWage

A. Employer Funding vs. Third-Party Financing

One of the most important distinctions is who funds the EWA benefit.

In many Direct-to-Consumer (D2C) models, third-party fintech companies front the funds and recoup repayment directly from the employee. This setup establishes a lending relationship, even if the provider doesn’t refer to it as a loan. It also shifts financial control away from the employer and into the hands of an outside entity.

By contrast, FlexWage’s model is employer-funded. That means your organization has complete control over the transaction from start to finish. Employees access wages they’ve already earned, not borrowed funds. As a result, there’s no debt, no interest, and no hidden credit risks.

This approach not only simplifies compliance but also builds trust.

B. Data Accuracy vs. Estimated Earnings

Accurate wage calculation is at the heart of a responsible Earned Wage Access solution.

Many D2C providers use projected hours or estimates based on AI algorithms, geo-location data, or historical earnings to determine how much an employee can access. While this may work in theory, it often leads to over-advances, repayment complications, and confusion, especially for hourly workers with variable schedules.

FlexWage does it differently. Because it integrates directly with employer payroll and time systems, it calculates earned wages in real-time or near real-time. Employees only access what they’ve actually earned, never more.

This level of precision builds confidence and ensures the program works seamlessly with existing payroll cycles. No guesswork. No overextensions. Just data-backed transparency that protects both employees and employers.

C. Payroll-Integrated Repayment vs. Wage Assignments

How repayment is handled may seem like a technical detail, but it carries significant consequences.

Some EWA vendors use wage assignments or require employees to reroute their entire paycheck through a third-party bank. These practices add layers of risk and complexity, often bypassing employer oversight entirely.

FlexWage takes a more responsible path. Repayment is handled through payroll-integrated deduction, which is automated, transparent, and fully auditable. There’s no need for employees to change banks or sign confusing wage assignment contracts. Employers retain visibility, and payroll systems remain intact.

It’s clean. It’s compliant. And it works the way payroll was intended to work.

D. Transparent, Capped Fees vs. Hidden Charges

The cost structure plays a significant role in determining whether an EWA program genuinely supports employee financial wellness.

Some providers offer “free” access up front, but later tack on fees for instant transfers, account maintenance, or failed payments. These hidden charges can erode employee trust and mimic the debt traps associated with payday loans.

FlexWage avoids these pitfalls with fixed, clearly disclosed fees. Employees always know what to expect. There’s no bait-and-switch. And because the employer funds the program, FlexWage has no incentive to push repeated use or charge excessive fees.

This predictability helps employees budget more effectively, and it is one of the core benefits of Earned Wage Access.

E. Employee Account Choice vs. Forced Cards or Accounts

A key value of FlexWage’s model is employee autonomy.

Some EWA programs require users to accept a proprietary pay card or open a new bank account to receive funds. These mandates can lead to unnecessary fees, limited access to cash, and frustration for workers who already have established banking relationships.

FlexWage takes a different approach. Employees can receive their earned wages through their preferred bank account or pay card, with no forced cards or banking gymnastics required. This freedom respects individual financial preferences and minimizes friction in adoption.

F. Instant Funding vs. Delayed Transfers

When employees face a financial emergency, timing is crucial.

Some EWA providers promise flexibility but require 1–3 business days to transfer funds, unless employees pay an extra fee for instant access. These delays (or pay-to-play models) defeat the purpose of EWA and introduce stress at the worst possible moment.

FlexWage prioritizes speed and simplicity. Earned wages are delivered instantly to the employee’s preferred account or pay card. No unnecessary delays. No upcharges. Employees’ access to wages they have already earned is quick and efficient.

This immediacy enhances the value of the benefit and increases employee satisfaction, particularly when facing time-sensitive expenses such as car repairs, medical bills, or rent.

G. Compliance-First Design vs. Legal Loopholes and Lawsuits

Not all Earned Wage Access models are designed to withstand legal scrutiny. Some providers rely on creative legal interpretations, wage assignments, or direct deposit hijacking to operate outside of employer systems. These workarounds may expose employers to regulatory risk, and in some cases, litigation.

The legal landscape for EWA is evolving quickly. From the CFPB’s 2020 Advisory Opinion to new laws in states like Missouri and Nevada, Earned Wage Access is under increased scrutiny. Providers that operate outside of employer systems, especially those that use wage assignments or ACH debits, may be classified as lenders, triggering Truth in Lending Act (TILA) compliance obligations.

FlexWage takes a different approach. From day one, our platform was designed with full compliance in mind, not just patched together to avoid regulatory definitions of credit or lending. We integrate directly with employer payroll systems, operate without loans or interest, and never require credit checks or external accounts.

FlexWage has secured regulatory exemptions and obtained legal opinions from multiple states, affirming that our solution is neither a loan nor a money transmission product. That clarity protects both employees and employers, reducing legal exposure and reinforcing your reputation as a responsible benefits provider.

When evaluating EWA solutions, compliance shouldn’t be an afterthought. Choose the model that was built for it.

7. How to Get Started with Earned Wage Access

If you’re considering offering Earned Wage Access (EWA), you’re not alone. More employers are recognizing its power to reduce financial stress, improve retention, and differentiate their benefits package in a competitive labor market.

But rolling out an EWA solution isn’t as simple as flipping a switch. To ensure the program aligns with your goals and complies with evolving state and federal laws, you’ll want to start with the right questions and the right partner, and understand who is responsible for EWA within your business.

Let’s walk through the following steps.

Questions to Ask a Potential EWA Provider

Choosing the wrong provider can expose your organization to regulatory risk, operational disruption, or employee backlash. That’s why due diligence is essential.

Here are the questions you should be asking:

- 1. Do you offer implementation support and engagement materials? The best providers don’t just turn on a benefit; they help you launch it successfully.

- 2. How is the EWA benefit funded? Is it employer-funded, or does the provider front the money as a third party? This determines whether the program functions more like a benefit or a loan.

- 3. How is repayment handled? Does the provider integrate with payroll for clean deductions, or are they using wage assignments and direct deposit rerouting?

- 4. Are fees disclosed and capped? Look for transparent, flat-fee models. Avoid “free” programs that monetize employees through hidden transaction or transfer fees.

- 5. Can employees choose their own bank account or pay card? Forced cards introduce friction and reduce adoption. Flexibility drives engagement.

- 6. Do you have legal opinions or regulator letters confirming compliance? Ask for documentation. Don’t rely on verbal assurances.

- 7. What employer controls are in place? You should be able to define eligibility, track usage, and measure outcomes.

Download Your Copy of The EWA Provider SELECTION GUIDE

Your guide includes Five Critical Elements and 22 Questions to help you thoroughly and objectively evaluate your current or future Earned-Wage Access (EWA) provider.

Resources for Launching an EWA Benefit

Once you’ve chosen a compliant, payroll-integrated EWA partner like FlexWage, implementation can be fast and frictionless.

Look for a provider that offers an employer launch kit with resources like:

→ Employee flyers and posters – Branded materials for break rooms, HR packets, and onboarding.

→ Digital signage and email templates – Ready-to-use assets for intranet announcements and company-wide rollout.

→ Custom intranet or benefits page content – Copy blocks you can drop into your internal systems to explain the benefit clearly.

→ FAQs and employee guides – Helps answer common questions and reduce helpdesk tickets.

→ Manager talking points and training decks – Empowers supervisors to speak confidently about the program.

→ Ongoing campaign support – For open enrollment, seasonal reminders, and re-engagement efforts.

FlexWage provides all of these engagement resources because education drives adoption. A well-communicated benefit is a well-used one.

8. Earned Wage Access (EWA) Benefits: Frequently Asked Questions (FAQs)

1. What is Earned Wage Access, and how does it work?

Earned Wage Access (EWA) is a financial wellness benefit that allows employees to access a portion of their earned wages before their scheduled payday. It integrates with employer payroll systems to track real-time earnings and deliver requested funds via direct deposit or pay card. Repayment is typically deducted from the employee’s next paycheck.

2. What are the main benefits of Earned Wage Access for employees?

The top benefits include reduced financial stress, fewer overdraft fees, avoidance of payday loans, improved budgeting, and greater financial flexibility. Access to earned wages gives employees control over their cash flow, helping them stay focused at work and present in their personal lives.

3. How does offering EWA benefit employers?

Employers that offer EWA report higher employee satisfaction, improved retention, reduced absenteeism, and better overall productivity. EWA also enhances your employer brand and demonstrates to your workforce that you value their well-being.

4. Is Earned Wage Access the same as a payday loan?

No. EWA is not a loan. Unlike payday loans, it involves no interest, no credit checks, and no debt. Employees access money they’ve already earned. Reputable providers, such as FlexWage, integrate EWA directly into payroll and adhere to clear compliance guidelines.

5. What is the difference between employer-integrated and direct-to-consumer EWA models?

Employer-integrated EWA connects directly with payroll systems and is funded by the employer. It provides complete visibility, control, and oversight of compliance. Direct-to-consumer (D2C) models often rely on wage assignments or bank redirects, which can introduce risk and operate outside employer systems.

6. Does Earned Wage Access affect payroll processing or tax reporting?

No. With employer-integrated solutions like FlexWage, payroll processes remain unchanged. EWA draws only from net earned wages and doesn’t interfere with tax withholding, garnishments, or direct deposits.

7. Are there fees for employees who use EWA?

Yes, but in FlexWage’s model, the fees are transparent, flat, and capped, with no surprise charges. Employees see the exact cost before confirming a transaction. This predictability helps with budgeting and builds trust.

8. Can employees choose where their earned wages are sent?

Yes. FlexWage enables employees to receive earned wages directly into their bank account or on the pay card of their choice. Unlike some providers that force proprietary cards or bank accounts, FlexWage supports genuine employee autonomy and financial flexibility.

9. Is Earned Wage Access legal and compliant with U.S. laws?

Yes. FlexWage’s EWA solution has received legal opinions and regulatory confirmations indicating that it is neither a loan nor a money transmitter under multiple state laws. It complies with guidance from the CFPB and aligns with key payroll and labor regulations.

10. How do we launch an Earned Wage Access benefit at our company?

It starts with choosing a compliant, employer-integrated provider, such as FlexWage. From there, FlexWage supports your implementation with a dedicated account manager, an implementation project plan, and offers a complete launch kit that includes manager training, employee flyers, FAQ sheets, digital signage, and open enrollment support, ensuring your team understands and adopts the benefit quickly.

9. Resources to Explore Earned Wage Access Further

If you’re looking to dive deeper into the benefits, implementation, and impact of Earned Wage Access (EWA), the following resources offer valuable insights.

From press releases and regulatory updates to expert blogs and real-world case examples, this curated list is designed to help HR leaders, payroll professionals, and business decision-makers make informed choices.

Explore these articles to learn how EWA is transforming financial wellness, enhancing employee retention, and driving business results.

References and Supporting Documentation

Review the current list of references and supporting documentation.

State Regulations, Findings, and Exemption/No Action Opinions

07/17/2025 – Maine Grants FlexWage Regulatory Exemption for Earned Wage Access Program

06/17/2025 – Missouri Division of Finance: Exemption From Licensing in Missouri

11/04/2024 – Nevada Department of Business and Industry Financial Institutions Division: FlexWage Licensure Determination Request

04/15/2024 – Payments Dive – FlexWage wins Vermont EWA carve-out

01/03/2024 – Connecticut Concludes FlexWage Earned Wage Access Not A Loan

07/15/2022 – FlexWage Receives Milestone Opinion from Kansas OSBC

02/17/2023 – FlexWage Receives First Of Its Kind Earned Wage Access Legal Opinion From California’s DFPI

Other Related Regulatory Topics

09/2021 – Conference of State Bank Supervisors (CSBS): Model Money Transmission Modernization Act

Articles & Blogs

10/03/2024 – How EWA Transforms Employee Lives: Real Stories of Managing Finances Between Paychecks

09/30/22024 – FlexWage Blog – The 2024 CFPB Interpretive Rule on EWA: Comprehensive Analysis and Revealing Insights

08/25/2024 – FlexWage Blog – Data Accuracy Differentiates EWA From Payday Loans

11/04/2024 – FlexWage Blog – Constructive Receipt and Earned Wage Access

10/25/2024 – FlexWage Blog – To Deduct Or Not To Deduct — The Facts About EWA Payroll Deductions

The On-Demand Pay Patent

10/05/2023 – FlexWage Blog – The OnDemand Pay Patent

Helpful EWA Guides

07/07/2025 – Your Employees Deserve Better: Building a Responsible EWA Program

03/12/2025 – How EWA Can Help HR Leaders Support Employees in 2025

12/09/2024 – Who is Responsible for EWA in Your Business?

11/02/2023 – 22 Urgent Questions To Help You Select The Best EWA Benefit Provider

EWA Done Right

FlexWage delivers “EWA Done Right” because it offers the most compliant, responsible, and transparent Earned Wage Access (EWA) solution in the market today.

Schedule an introduction call today!

Keep exploring and learning >>>>> Who is Responsible for EWA in Your Business?