Misleading EWA state payroll deduction issues are used by some Earned Wage Access (EWA) vendors when promoting their EWA solutions. This article is a part of our EWA Fact Check Series designed to clarify claims and disclose disinformation on regulatory matters in the EWA industry.

Estimated reading time: 5 minutes

Key Terms

EWA = Earned Wage Access. Earned Wage Access, also called on-demand pay, is a voluntary financial wellness benefit. It allows employees to access a portion of their net earned and accrued wages, when needed, between pay cycles.

Payroll Deduction. Payroll deduction is a part of the normal payroll process. The EWA funds and the transaction fee are documented as an after-tax voluntary deduction on the wage statement (similar to a health club membership benefit).

Payroll Intercept. Payroll intercept is outside of the normal payroll process. After payroll is run for employees enrolled in EWA, the payroll record and funds (post taxes and deductions) are sent to the EWA vendor. The vendor deducts the EWA funds previously given to the employee and any fee. The vendor then “pays” the employee the remaining balance via a payroll card or via direct deposit into an employee’s bank account.*

| *Beware Payroll Intercept EWA vendors who direct deposit an employee’s net payroll into a bank account mandated by the EWA vendor. Account and card mandates are not allowed per the Electronic Fund Transfer Act, and Regulation E. Mandates also invalidate the CFPB’s definition of a “Covered EWA Provider.” Account mandates place the vendor and your EWA program at risk of being designed as credit subject to TILA regulatory compliance. |

The Misrepresented Claim About EWA State Payroll Deduction Issues

“Some states restrict payroll deduction of EWA transfers because they reduce wages below minimum wage.”

The Disinformation Diversion

When using the misrepresented claim above, a vendor may say:

“State X prohibits payroll deductions that reduce an employee’s wages below minimum wage. You shouldn’t use a payroll deduction in your EWA solution, our solution protects you from this regulation.”

States often cited for this diversion include Alabama, Colorado, Kansas, and Vermont.**

Some states do prohibit payroll deductions that bring an employee’s paycheck to a level where they’d make less than minimum wage.

When employers make deductions for breakage, losses, the cost of uniforms, and more, it is not hard to imagine that if all those deductions took place in one pay period, the employee wouldn’t have much left in their paycheck.

And yet, this topic is a diversion when discussing the pros and cons of an EWA model. So, let’s dig into the facts.

| **Sometimes misinformed EWA vendors mention the states CT, DE, DY, MN, MT, NH, and NJ because these states require an employee’s written authorization for deductions. (Written authorization is a part of most EWA sign-up processes. So, again, a diversion). |

The Facts About EWA State Payroll Deduction Issues

Consider the following three facts when evaluating the claim that EWA funds recovery should not use payroll deductions.

1. FLSA and Federal Minimum Wage Regulations

Employers are required to pay a federal minimum wage (as regulated by the Fair Labor Standards Act (FLSA)).

Therefore, whether you provide EWA benefits or not, you must pay the federal minimum wage.

Additionally, if the EWA vendor, or you as the employer, pay employees with a payroll card, you must ensure that any associated fees do not cause the employee’s pay to drop below minimum wage.

No matter what, always monitor your employee’s pay and associated deductions and fees. Ensuring you meet federal minimum wage regulations is not unique to EWA solutions, as some vendors imply.

2. Avoiding or Circumventing the Minimum Wage Regulations

Avoiding federal minimum wage regulations by recovering EWA funds outside of a payroll deduction is a dubious attempt to sidestep regulatory compliance.

How will you respond when the regulatory agency asks why you circumvented the payroll deduction to avoid the minimum wage laws?

Warning, “I didn’t know,” probably won’t get you out of trouble. Neither will “it was the third-party provider who did it, not me.” If you signed a contract, you are ultimately responsible.

It is always the employer’s responsibility to pay their employees, not a third-party provider to the employer.

3. Voluntary Benefit Deductions Are Permissible

Voluntary benefit deductions, authorized by the employee, are allowed. A simple review of each state’s regulations confirms this.

Some of the most popular voluntary benefits today are not listed in the state’s existing regulations as permissible. After all, these benefits did not exist when the regulators passed the laws. Examples include Identity Theft, Pet Insurance, and Group Legal, to name just a few.

The purpose of payroll deduction restrictions is to prevent employer abuse, not to prevent helpful employee-authorized benefit deductions.

The Misdirect

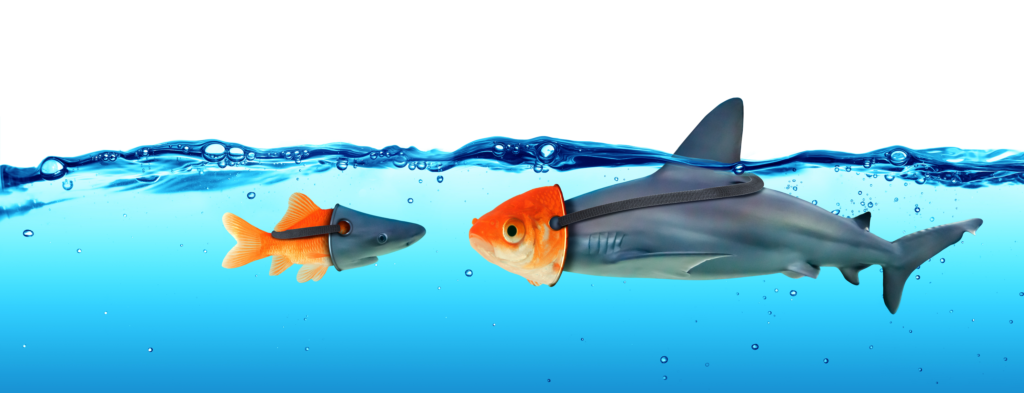

Why would an EWA provider provide misleading information about payroll deduction regulations? We believe some EWA vendors use misleading information to redirect the attention of their prospects and customers away from their noncompliant EWA models.

The Mandated Payroll Card

An EWA model that doesn’t use payroll deduction to recover the EWA transferred funds uses a process called payroll intercept.

After running normal payroll, the EWA participating employees’ payroll funds are sent to the EWA vendor to be processed. The EWA vendor deducts the EWA transfer and fees and then sends the rest of the payroll funds to the employee.

To participate in the EWA benefit program, the employee must agree to receive their funds on a payroll card. The result is that the payroll card is mandated, which puts the employer (not just the vendor) in non-compliance with The Electronic Fund Transfer Act (EFTA) and Regulation E.

These EWA vendors are mandating their payroll cards not only for EWA benefits but also for payroll.

Can you name any other “voluntary benefit” that mandates the use of a payroll card for payroll and the use of the benefit? FSA, HSA, 401k, and even small-dollar loans don’t require the employee to receive the deposit of their paycheck onto a provider-issued card account after enrollment. Why, then, is this a part of an EWA benefit program?

Payroll Card Regulations

The Electronic Fund Transfer Act and Regulation E prohibit employers from forcing employees to receive wages via a payroll card.

As stated in the Consumer Financial Protection Bureau (CFPB) Bulletin 2013-10, published September 12, 2013, “Regulation E prohibits employers from mandating that employees receive wages only on a payroll card of the employer’s choosing.”

Any agreement you sign with an EWA provider makes you responsible for anything that the provider does that is non-compliant. Your reputation, and the reputation of your employees, management, and board of directors, are on the hook.

A Trusted and Compliant EWA Solution

Get all the facts and ask for proof when EWA providers begin making regulatory compliance claims they cannot substantiate.

Compliance concerns are the #1 reason that employers delay implementing EWA for their employees. With rampant misinformation as reviewed here, it is no wonder.

EWA Done Right is what employers and employees deserve. Choose carefully when selecting an EWA program for you and your employees.

A Trusted Voice in EWA Compliance

This article is a part of our EWA Fact Check Series designed to clarify claims and disclose disinformation on regulatory matters in the EWA industry.

Please schedule a call with us today if you’d like more information on how EWA vendors misrepresent payroll deduction issues when promoting their EWA solutions.

Keep exploring and learning >>>>> To Deduct Or Not To Deduct — The Facts About EWA Payroll Deductions