The Consumer Financial Protection Bureau (CFPB) recently proposed an Interpretive Rule regarding Earned Wage Access (EWA) programs. The rule is still in the comment phase of the process. If it advances as it currently stands, all EWA products, whether employer-based or direct-to-consumer (D2C), will be considered loans and subject to the Truth In Lending (Regulation Z) consumer protections. In this blog, we comprehensive analyze the rule and provide revealing insights into its potential impact on the EWA landscape.

Estimated Reading Time: 14 minutes.

The Goals of the Proposed CFPB Rule

The Consumer Financial Protection Bureau (CFPB) plays a vital role. It protects consumers from financial harm and promotes fairness and openness in the financial industry.

In the recently proposed interpretive rule, Truth in Lending (Regulation Z); Consumer Credit Offered to Borrowers in Advance of Expected Receipt of Compensation for Work, the CFPB defines four goals for the paycheck advance industry:

>>>>> 1. Promote innovation and competition in consumer financial services and products.

>>>>> 2. Clarify the application of Federal laws such as TILA and Regulation Z in paycheck advance financial products.

>>>>> 3. Help consumers by “address[ing] the credit needs of households who incur costs due to a mismatch in the timing of their income and expenses.”

>>>>> 4. Protect consumers from unfair treatment.

Three Crucial Insights From The CFPB Interpretive Rule

We agree with the Consumer Financial Protection Bureau (CFPB) conclusions that:

1. Current payroll processes create short-term credit needs due to the mismatch between pay and bills, increasing debt for millions of Americans.

2. Expedited delivery fees to move funds instantly to the employee’s account of choice create confusion and complaints. The U.S. Government Accountability Office (GAO) study and the California Department of Financial Protection and Innovation (DFPI) data findings and analysis also make this conclusion.

3. “Tips” models are unnecessary and introduce significant opportunities for confusing, opaque, and unfair marketing practices.

The CFPB Must Clearly Distinguish Between Employer-Partnered and D2C EWA Programs

In our response to the CFPB, FlexWage recommends that the CFPB modify the 2024 Paycheck Advance Interpretive Rule to clearly distinguish between employer-partnered EWA programs and new forms of direct-to-consumer (D2C) online and app-based payday loans.

We contend that new D2C products often masquerade as EWA. These products have no connection to actual, accurate employee data. This lack of connection fails to ensure the accurate calculation of real earned wages.

As Todd H Baker, Senior Fellow, Richman Center at Columbia University, states, the FlexWage model “doesn’t involve a credit extension in any coherent sense of the term.”

According to Justine Zinkin, CEO of Neighborhood Trust Financial Partners, “Given that so many workers today are struggling to make their paycheck stretch between paydays, solutions that help bridge that gap are an important resource until we address the deeper drivers of that insecurity. In that context, it’s critical for regulators such as the CFPB to create safeguards to protect workers from being exploited by expensive or even predatory products while maintaining access to safer, more productive products. FlexWage is an example of a safer product in the EWA landscape, offering relatively affordable access to earned wages and complementary financial tools to encourage reduced dependency on repeated borrowing. FlexWage’s OnDemand Pay product is, in fact, offered to Neighborhood Trust employees as a benefit, signaling our support of their approach and their mission-aligned efforts to interrupt, rather than perpetuate debt cycles.”

Who is the CFPB, and Why Do They Care About EWA?

The Consumer Financial Protection Bureau (CFPB) is a U.S. government agency that protects consumers from financial harm. It promotes fairness and transparency in the financial industry. The CFPB addresses deceptive or predatory practices and ensures clarity and fairness in financial dealings.

The Truth In Lending Act (TILA)

The CFPB is responsible for enforcing the Truth In Lending Act (TILA) and ensuring lenders comply with its provisions. TILA is a federal law enacted in 1968 to promote the informed use of consumer credit by requiring disclosures about its terms and costs. The act protects consumers in their dealings with lenders and creditors by ensuring transparency and fairness in the credit market.

The CFPB enforces TILA through its regulatory powers. It also investigates consumer complaints and can take enforcement actions against lenders that violate TILA. Consumers can file a private lawsuit against a lender for TILA violations.

TILA and Regulation Z

Regulation Z is the part of the Code of Federal Regulations that implements TILA.

TILA and Regulation Z define what to do if you offer credit to consumers. TILA requires lenders to disclose key credit terms to consumers clearly and concisely. It also gives consumers the right to cancel certain credit transactions within three days.

Additionally, TILA prohibits certain lending practices that are deemed unfair or deceptive. For example, lenders can’t charge higher interest rates based on a borrower’s race or ethnicity, and it limits certain fees that they can charge to consumers.

TILA also gives consumers the right to dispute errors on their credit reports and requires credit reporting agencies to investigate and resolve such disputes.

Overall, TILA and Regulation Z work together to ensure consumers are well-informed and protected in their credit transactions. They promote fair lending practices and financial transparency.

Earned Wage Access (EWA) Explained

In 2009, FlexWage Solutions LLC launched the original EWA solution with a clear purpose:

To provide the more than 70% of people working paycheck-to-paycheck with an accurate, no-loan, no-risk, responsible, low-cost cash flow management solution.

What is EWA?

EWA is a voluntary financial wellness benefit that allows employees to access their net earned wages between pay periods. When emergencies arise, employees can access what they’ve earned instead of bouncing checks, borrowing money, or using high-interest credit cards.

Two models have emerged to give employees access to their earned wages. The first is through an employer. This type of EWA is called employer-funded, employer-integrated, business-to-business (B2B), or business-to-business-to-consumer (B2B2C). When the contract is with the employer, integration is possible with HR and payroll systems, making it possible for the EWA vendor to calculate available wages accurately.

The second type of EWA is vendor-funded, direct-to-consumer (D2C), or business-to-consumer (B2C) —in these models, the EWA vendor contracts directly with the employee/consumer. Information about the employee’s wages comes from the employee, either from banking history, tracking an employee’s location via their phone, or AI estimates. Accurate wage calculations can’t be verified because there is no connection to the employer’s payroll system.

EWA must be connected to an employer’s HR and payroll systems to verify the employee’s net wages earned. Without such data connections, an EWA program has nothing to do with earned salaries and is, in fact, a consumer loan.

The Real EWA

Real EWA is not a loan. Real EWA solutions enable employers to pay their employees between pay cycles.

>>>>> EWA contracts with the employer. The separation of the EWA vendor from the employee guarantees there are no wage assignment terms and conditions. This separation also ensures that employees can access only one EWA solution at a time.

>>>>> EWA requires accurate net accrued wage calculations. Therefore, real EWA requires integration with payroll data, including payroll deductions (such as tax withholding, healthcare programs, and garnishments). Real EWA must also include time and attendance data to validate accurate earned wages before allowing EWA transfers.

>>>>> EWA is not predatory. EWA is an option, like an ATM transaction, to access earned wages. Charging a per-transaction fee and then capping those fees per pay cycle and month (based on the frequency of usage) is the most transparent and responsible way to minimize employee fees. Whether the employer or employee pays the fee, a fee structure is required to deliver the benefit and fund the necessary technology.

>>>>> EWA is a voluntary employee benefit program. The employer deducts EWA funds and fees from the employee’s paycheck. Deducting EWA transactions and any fee amounts from an employee’s payroll and showing them as line-item deductions on the pay statement keeps everything fully transparent and employment-centric, clearly differentiating an employer-based solution from other D2C or hybrid options. Post-payroll processing creates differences between the paystub and net deposit, creating questions and compliance issues. Fund recovery outside payroll deduction can also generate overdraft fees, especially when employees can stack small-dollar loans from multiple direct-to-consumer providers.

Imitation EWA Products

D2C products are not real EWA solutions. When the relationship is between the vendor and the consumer, the transactions have nothing to do with earned wage access. We contend that these D2C products masquerade as EWA when they have no connection to actual, accurate employee data to enable the calculation of accrued earned wages.

A Brief History of EWA and The CFPB

As the original patent holder behind EWA, FlexWage has engaged with the CFPB for over a decade.

We had extensive discussions with the CFPB before they introduced the Payday Lending Rule in 2017, which provided an exemption for Wage Advances (the former moniker for EWA).

FlexWage was also involved with the CFPB when they released their Advisory Opinion on EWA on November 30, 2020. The opinion provided specific and distinct characteristics of a non-loan EWA service, setting it apart from all other payday loan products.

Unfortunately, when we look at the market today, we see all types of providers claiming to be EWA without meeting any of the criteria necessary to protect consumers.

EWA is a voluntary financial wellness benefit that allows employees to access a portion of their net earned wages between pay periods. When emergencies arise, employees can access what they’ve earned instead of being subject to overdrafts, payday loans, title loans, pawn shops, or high-interest credit cards.

We agree with the CFPB that Payroll Advance programs not connected to an employer’s payroll and time systems have nothing to do with earned wage access and should, therefore, be classified as loans.

2017 CFPB Payday Lending – Wage Advance Exemption

“Advances of wages under § 1041.3(d)(7) must be offered by an employer, as defined in the Fair Labor Standards Act, 29 U.S.C. 203(d), or by the employer’s business partner to the employer’s employees pursuant to a wage advance program.”

“Under the exclusion in § 1041.3(d)(7)(i), the advance must be made only against accrued wages. To qualify for that exclusion, the amount advanced must not exceed the amount of the employee’s accrued wages. Accrued wages are wages that the employee is entitled to receive under State law in the event of separation from the employer for work performed for the employer, but for which the employee has yet to be paid.”

FlexWage supports the exclusion defined in the rule to maintain consumer protections while providing for a scalable and sustainable program operation.

2020 CFPB Advisory Opinion

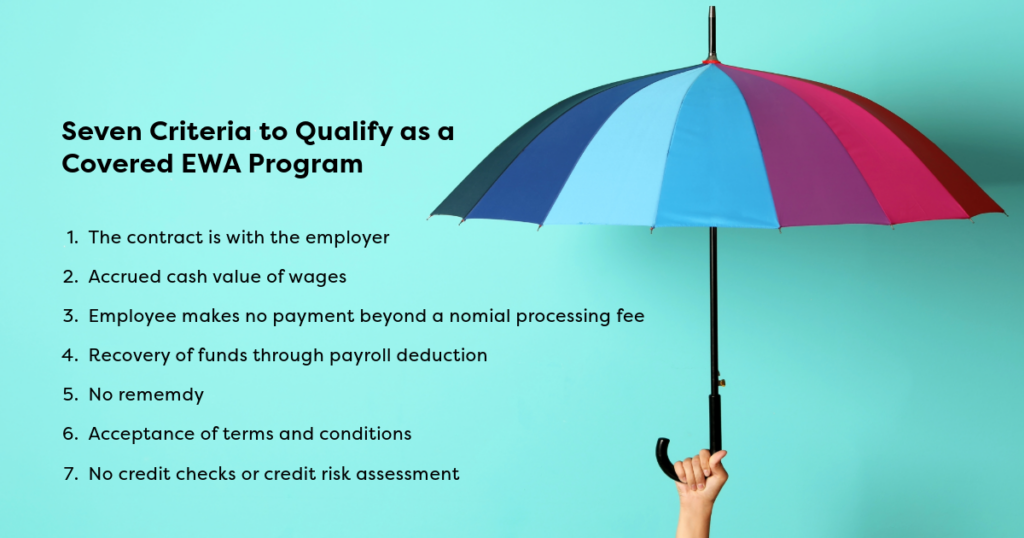

In its advisory opinion, the CFPB stated that if an EWA provider met its seven criteria, it would be considered a “Covered EWA Program” and would not be subject to Regulation Z of TILA. These criteria clearly defined EWA and differentiated it from every other type of payroll advance, creating consumer protections and a clear operation path for providers offering EWA solutions to employers.

Image: Colorful, extended umbrella held open by a hand, covering text explaining the seven criteria to qualify as a CFPB-covered EWA program.

The seven criteria are:

(1) The contract is with the employer

(2) Accrued cash value of wages

(3) Employee makes no payment beyond a nominal processing fee

(4) Recovery of funds through payroll deduction

(5) No remedy

(6) Acceptance of terms and conditions

(7) No credit checks or credit risk assessment

Below, we explore each criterion in detail.

(1) The Contract Is With The Employer

The first criterion focuses on who the contract for EWA services is with: the employer or the employee.

“(1) The provider of the Covered EWA Program (provider) contracts with employers to offer and provide Covered EWA Transactions to the employer’s employees.”

FlexWage agrees that this criterion is critical to delivering a safe and responsible solution to employers and employees.

When the legally binding agreement is with the employee (aka the consumer), the terms and conditions may include wage assignments and other items that more closely resemble that of a consumer lender rather than an EWA provider.

An additional layer of protection is created by requiring that the EWA agreement is between the employer and employee.

(2) Accrued Cash Value Of Wages

The next criterion focuses on accrued wages. First, the employer must provide data to calculate the employee wages. Second, the amount of the EWA transfer can be, at most, the accrued value of earned wages. The CFPB drew the analogy of the wages an employee would be entitled to if the employee separated from the job.

As previously stated, verifying actual wages earned without data from an employer is impossible. Inaccurate or incomplete data is ambiguous and harms the consumer.

Why did the original CFPB guidance focus on the “accrued value of earned wages?” One of the debates regarding Regulation Z was whether borrowing against an insurance policy or retirement plan is, in fact, a loan. The determination was that the consumer was not borrowing but using their own money in such instances. In the same way, accurate accrued wages are the employee’s own money, not a loan.

Wages, however, must be accurately calculated from data held by the employer. This data includes capturing time punches to create reasonable assurance that employees have worked and earned wages. Using algorithms, geolocation data, or guessing actual hours worked is insufficient.

(3) Employee Makes No Payment Beyond A Nominal Processing Fee

The third criterion addresses EWA program participation and transaction fees. To be a “Covered EWA Program,” the EWA vendor cannot charge participation fees. The CFPB noted that charging a “nominal processing fee” differs from a program participation fee.

This third criterion makes monthly subscription EWA programs non-compliant.

The EWA vendor cannot charge to open an account or transfer funds to the employee’s account of choice.

This criterion also makes EWA programs that charge fees to transfer EWA funds to an employee’s debit card noncompliant but provide an exception for nominal fees.

The Advisory Opinion states, “The Bureau notes that there may be EWA programs that charge nominal processing fees—and thus differ from the fee structure described in this section B (3)—that nonetheless do not involve the offering or extension of ‘credit’ as defined in § 1026.2(a)(14).” By making an exception for “nominal processing fees,” the CFPB acknowledges that instantly moving EWA funds to the employee’s account of choice has a cost.

As outlined in the Payactiv opinion issued by the CFPB on 12/30/20, transaction fees for the instant delivery of these funds to a bank account of choice were considered nominal and covered under the EWA criteria. FlexWage supports the CFPB’s nominal fee definition. ATM cash access convenience fees are higher than FlexWage fees. The average out-of-network ATM fee is $4.67, and the average out-of-network cash withdrawal amount is $124.

FlexWage’s capped fee structure is one of the criteria used by the California Department of Financial Protection and Innovation (DFPI), the Kansas Office of the State Bank Commissioner, the Connecticut Department of Banking, and the Vermont Department of Financial Regulation in their opinions that state that FlexWage EWA does not require a lending license in these states.

(4) Recovery of Funds Through Payroll Deduction

The fourth criterion ensures transparency and clarity of the EWA transaction. EWA funds recovery takes place through a payroll deduction. The employee’s pay statement shows the EWA funds transfer and any fees.

The employee’s gross earned wages, all taxes and deductions, and net pay are listed on the pay stub, making it easy and transparent for the employee to see the deduction.

Any other kind of funds recovery that removes the transparency and protections paramount to consumers is noncompliant with the CFPB and the Department of Labor.

The fourth Covered EWA Program criteria also specify how to handle technical or administrative issues (overpayments). The CFPB allows for one additional payroll deduction if a pay calculation error or a technical (API) error occurs.

Repeated attempts to recover funds disqualify the EWA program, turn the program back into a loan, and create potential harm to the employee.

Some programs require a vendor to control employee wages as part of the process. Employees who enroll in these EWA programs have their entire payroll direct deposit sent to the provider. The provider then deducts their transaction and fee amounts and proceeds to deposit the remaining pay into the employee’s account. This method confuses the employee as their wage statement and net deposit differ. Additionally, the employer loses visibility of the accuracy and timeliness of the employee’s pay. The employer risks non-compliance and a lack of protection for the employee. While the employer is still accountable for accurate and timely pay, they no longer have control over payroll and direct deposit.

Trust and compliance issues arise when an unlicensed third party stands between an employer and the employee’s pay. If the employer does not recover EWA funds through a payroll deduction, the program is a loan, and the provider is, in fact, a lender.

(5) No Remedy

The fifth criterion requires EWA programs not to attempt to recover monies from the employee.

Any EWA provider who tries to pursue an employee for repayment is a loan provider, not an EWA provider. Repeated attempts to collect overpayments from an employee’s bank account can harm the employee. This often happens when the provider uses less-than-accurate data. Such attempts can cause overdrafts and lead to the suspension of the service meant to be an employee benefit.

(6) Acceptance of Terms and Conditions

The sixth criterion focuses on comprehensive disclosures. It requires EWA programs to provide clear and accurate information about the service’s terms and conditions. This includes outlining any potential risks or limitations. An EWA vendor who doesn’t clearly specify these terms and conditions violates the Covered EWA Program defined by the CFPB.

(7) No Credit Checks or Credit Risk Assessment

Lastly, the seventh criterion requires EWA programs to refrain from assessing an employee’s credit risk or conducting credit checks.

When an EWA vendor can access an employee’s bank account data or employment history, they can use this information. This access allows them to assess the employee’s credit risk. Employers must understand how an EWA vendor uses the data to ensure compliance with the CFPB Covered EWA Program criteria.

We agree with the CFPB’s assertions that there is a need for short-term credit options due to compensation delays imposed by employers. And we also support the agency’s mandate to protect consumers in financial markets and transactions.

Employer-Funded EWA Programs Are Not Loans

We respectfully maintain that employer-funded EWA programs are not loans. Instead, they are an optional convenience provided by the employer. These programs allow employees to access their earned wages before payday.

Five Elements of An Employer-Funded EWA Program

Image: Five triangles organized into a pentagon illustrating the FlexWage EWA Model Components: Funding, Accuracy, Responsible, Choice, Clarity.

FlexWage believes that the following five EWA model elements are required to ensure a safe, responsible, transparent, and scalable EWA solution:

1. Funding—The employer funds EWA.

Employees and EWA solution vendors (providers) should remain separate and independent of each other. An employer-funded EWA solution achieves this separation. (Alternatively, a licensed provider may offer a line of credit to assist the employer in funding the EWA solution.)

There is no need for any provider to fund an employee’s account or directly debit their bank account. Providers should not require employees to assign their wages to them. Insulating the employee from the provider differentiates the EWA solution from payday lenders and other direct-to-consumer products claiming to be EWA. Additionally, any third party outside the employer funding payroll is a loan.

2. Accuracy—Data accuracy in EWA calculations.

The connection to payroll and time reporting systems ensures the accuracy of data used to calculate accrued wages at the employee level. In addition, it prevents estimations and any risk assessments by providers that may unfairly discriminate. Using accurate and current data ensures the same calculations for every employee. This eliminates the possibility of any arbitrary or discriminatory practices. This process also minimizes the chance of employees receiving more than they have earned. It aligns with a company’s diversity, equity, and inclusion (DEI) initiatives. Using a third-party integrator to access employee information via a portal increases the risk of privacy breaches. Allowing the third party access to numerous other pieces of data (i.e., tenure, raises, marital status, gender, ethnicity, and annual salary) that have no bearing on a person’s earned wages creates privacy concerns for employee data.

3. Responsible—Transparent and capped EWA fees.

Consumers understand and willingly pay for EWA solutions that provide instant access to funds. These solutions charge nominal transaction fees consistent with an ATM withdrawal. Charging a per-transaction fee and capping those fees per pay cycle and month is the most transparent way to minimize employee fees. This approach is based on the frequency of usage and ensures a responsible fee structure.

4. Choice—Instant funding to the employee’s account of choice.

In some EWA models, employees must first send EWA transfers to a provider-owned card or account and then transfer the funds back to their own bank account. For additional varying fees, providers allow employees to instantly transfer EWA funds to their bank accounts. These extra steps and fees create an unnecessary and non-transparent process for the employee. EWA providers should protect users from these non-transparent add-on fees by offering real-time EWA funding directly to the employee’s account of choice.

5. Clarity—Payroll deduction of EWA transactions.

Deducting EWA transactions and any fee amounts from an employee’s payroll ensures transparency. Showing these deductions as line items on the pay statement keeps everything employment-centric. This approach clearly differentiates an employer-based solution from other direct-to-consumer or hybrid options. Making deductions post-payroll creates differences between the paystub and net deposit, leading to questions and compliance issues.

State banking agencies in California, Connecticut, Kansas, and Vermont have reviewed and evaluated the five FlexWage model components. they all agree that the FlexWage EWA program is not a loan.

Transparency, Fairness, and Consumer Protection

The proposed CFPB interpretive rule on Earned Wage Access (EWA) marks a pivotal moment for the industry, with significant implications for employers and employees. As we navigate these changes, it’s crucial to distinguish between employer-partnered EWA programs and the emerging direct-to-consumer models. FlexWage is committed to advocating for solutions that uphold transparency, fairness, and consumer protection. To learn more about how this rule may impact your business and explore how EWA can benefit your workforce, contact us today. We’re here to provide insights and guide you through these regulatory changes with expert advice tailored to your needs.

EWA Done Right

FlexWage delivers “EWA Done Right” because it offers the most compliant, responsible, and transparent Earned Wage Access (EWA) solution.

Schedule an introduction call today!

Keep exploring and learning >>>>> Data Accuracy Differentiates EWA From Payday Loans