The GAO Fintech Study — Insights and Commentary

The US Government Accountability Office (GAO) recently released its 2023 Financial Technology Study titled, “Product Have Benefits and Risks to Underserved Consumers, and Regulatory Clarity Is Needed.” Their study is an important review of Earned Wage Access (EWA) models, including features, benefits, and risks.

As the original patent holder of OnDemand Pay and Earned Wage Access, the team at FlexWage has summarized the key points of the study below.

Estimate reading time: 5 min

Two EWA Business Models

The GAO Study focuses on the two Earned Wage Access (EWA) business models, as described below:

1. Employer-sponsored

With the employer-sponsored model, “the fintech company partners with employers in order to access time and attendance information. This model gives consumers on-demand access to a certain amount of their earned wages prior to payday; consumers then repay that amount by having it deducted from their next paycheck.”

2. Direct-to-consumer

With the direct-to-consumer model, “the fintech company interacts with consumers without involving the employer, connecting to their bank accounts to identify past income and estimate future wages. This model gives consumers access to funds based on this estimated amount of future income, and consumers repay by having that amount deducted from their bank account after payday.”

GAO Sighted Benefits of EWA Products

The study goes on to discuss the benefits of EWA and several studies that support the benefits. The benefits listed include the following:

>>> Solving short-term-liquidity challenges

>>> Access to funds without a credit check

>>> Lower cost than other liquidity solutions such as payday loans

GAO Highlighted Risks of EWA Products

The GAO study also highlighted the Earned Wage Access (EWA) risks to consumers as follows:

Lack of transparency regarding costs.

Cost transparency risks include expedited funds delivery fees, tip collection, and monthly subscription fees. These are areas that can present a lack of transparency for consumers.

Additional costs.

The study highlights “unexpected costs” incurred when the EWA provider debits the consumer’s bank account, causing potential overdraft fees.

Dependency of usage.

Many consumer advocates have expressed concerns about consumers becoming dependent on EWA usage rather than improving their financial challenges.

Inaccurate wage estimation.

Direct-to-consumer EWA models use direct deposit information to guesstimate EWA wage calculations.

One model uses GPS location data to guess how long an employee was at a work location.

These inaccurate wage estimations can create overpayments that make consumers struggle to repay the EWA transfer. And in some cases, the suspension of the EWA service to the consumer until the overpayment is repaid.

EWA Operational Differences

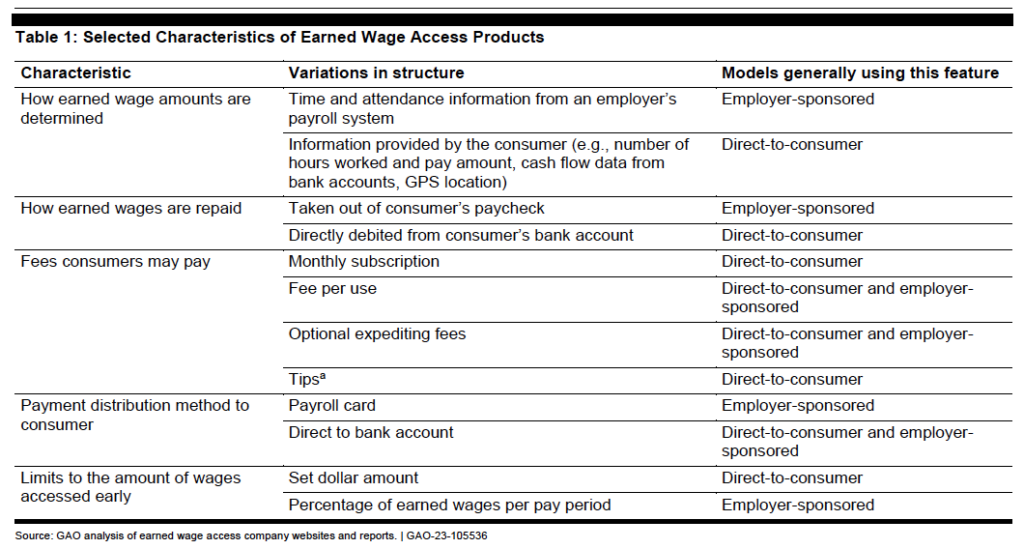

In their analysis, the GAO identified several characteristics of Earned Wage Access (EWA), including how earned wages are calculated, how funds are delivered and recovered, types of consumer fees, and policy controls (see image below).

Chart: GAO Financial Technology Study, Table 1. Selected Characteristics of Earned Wage Access Products.

The GAO noted that one direct-to-consumer model allows a consumer to access more of their earned wage for referrals of other consumers to their offering. (Something that has nothing to do with earned wages and everything to do with the EWA vendor marketing their service!)

Timeline Of CFPB And EWA

The GAO study also discusses the steps the Consumer Financial Protection Board (CFPB) has taken this past year to bolster its oversight of nonbank financial companies that pose consumer risks.

April 2022

“In April 2022, CFPB announced its intention to invoke a largely unused legal provision to supervise nonbank financial companies that provide consumer financial products or services and that CFPB has reasonable cause to determine are engaging in conduct that poses risks to consumers, including potential violations of federal consumer financial law. The provision requires CFPB to make the determination by order, after notice and a reasonable opportunity to respond, based on consumer complaints or information from other sources. CFPB recently invoked this authority in response to the rapid growth of consumer offerings by nonbanks, and so that the agency can adapt quickly to changing market conditions.”

June 2022

The CFPB noted in a press release that it planned “to issue further guidance soon to provide greater clarity concerning the application of the definition of ‘credit’ under the Truth in Lending Act and Regulation Z” for earned wage access products.

December 2022

“In December 2022, CFPB issued a proposed rule that would require certain nonbanks to register with and submit information to CFPB when they become subject to certain orders from local, state, or federal agencies or courts involving violations of certain consumer protection laws that arise out of conduct in connection with offering or provision of a consumer financial product or service.”

January 2023

“In January 2023, CFPB issued a proposed rule that would require nonbanks subject to CFPB’s supervisory jurisdiction to register with and submit information to CFPB if they use specific terms and conditions in form contracts that claim to waive or limit consumer rights and protections.”

State Regulatory Authority Over EWA

Additionally, the GAO study discusses state regulatory supervisory authority over Earned Wage Access (EWA) services directly or via the state-chartered banks through which EWA providers may offer their services.

The CFPB cited the need for clarity regarding federal and state definitions of the word “credit” and how it applies to EWA products, “…the advisory opinion does not address whether such products would be ‘credit’ under the Consumer Financial Protection act (CFPA) or the Equal Credit Opportunity Act (ECOA), much less whether these products would be ‘credit’ under state law. The CFPA, ECOA, and the usury law of many states do not share TILA’s technical definition of credit and creditor.”

It is worth noting that California’s Department of Financial Protection and Innovation (DFPI) opinion was issued in February 2022 and shared with the CFPB before any of the announced CFPB changes. This first-of-its-kind legal opinion stated that “for its EWA solution, neither FlexWage nor its employer partners are subject to licensing requirements by the California Financing Law (CFL) or California Deferred Deposit Transaction Law (CDDTL).”

The DFPI emphasized that the following characteristics of the FlexWage model made their decision possible:

>>> Employer-funded EWA model

>>> Data integration with payroll and time/labor systems that enables accurate calculation of net earned wages

>>> Instant transfer delivery of EWA funds to employee’s account of choice

>>> Flexible fee structure and fee caps per pay period and month

FlexWage has passed the regulatory scrutiny of both California and Kansas regulatory agencies. Additionally, the newly proposed DFPI regulations (PRO 01-21) provide further clarity on the direction regulators are taking and are consistent with the opinions and the steps taken up to this point.

GAO Concludes That Further Clarification Is Required

Lastly, the GAO study states:

“In particular, it remains unclear how the Truth in Lending Act’s definition of credit should be applied to earned wage access products, specifically those that do not fall under CFPB’s November 2020 advisory opinion. CFPB has indicated that it plans to issue further guidance to clarify this issue. Publishing additional clarification would help companies that offer these products understand whether the act and its disclosure requirements are applicable to them.”

The CFPB, other regulatory agencies, and congress have received the GAO study. The CFPB stated they agreed with the findings of this study. Time will tell what the CFPB will decide. Still, based on past agency behavior, more regulation seems to be coming for Earned Wage Access (EWA) products.

EWA Done Right

FlexWage delivers “EWA Done Right” because it offers the most compliant, responsible, and transparent Earned Wage Access (EWA) solution in the market today.

FlexWage was founded in 2009 by Frank Dombroski, who pioneered and patented OnDemand Pay and Earned Wage Access. Since its inception, FlexWage Solutions has been in ongoing communication with numerous federal and state regulatory agencies and consumer advocates. These agencies include the U.S. Consumer Financial Protection Bureau (CFPB), the Department of the Treasury, the Office of the Comptroller of the Currency (OCC), the U.S. Treasury, the National Economic Council (NEC), the California Department of Financial Protection and Innovation (DFPI) and numerous other states.

Get your EWA questions answered by the most experienced team in the industry. Schedule an introduction call today!

Keep exploring and learning >>>>> Misleading EWA State Payroll Deduction Issues